Of course you are not a shady supplier

And your prospective customers are aware of your ethical credentials, right? What about your employees?

TL;DR

- With ESG occupying ever more corporate bandwidth, there is more than just ESG reporting to be done, there are ESG-related revenue opportunities to be explored.

- ESG disclosure or reporting requirements aren’t mandatory for private companies, but employees expect transparency on the ethical positioning of their employers.

- ESG sustainability is every company’s passport for the future.

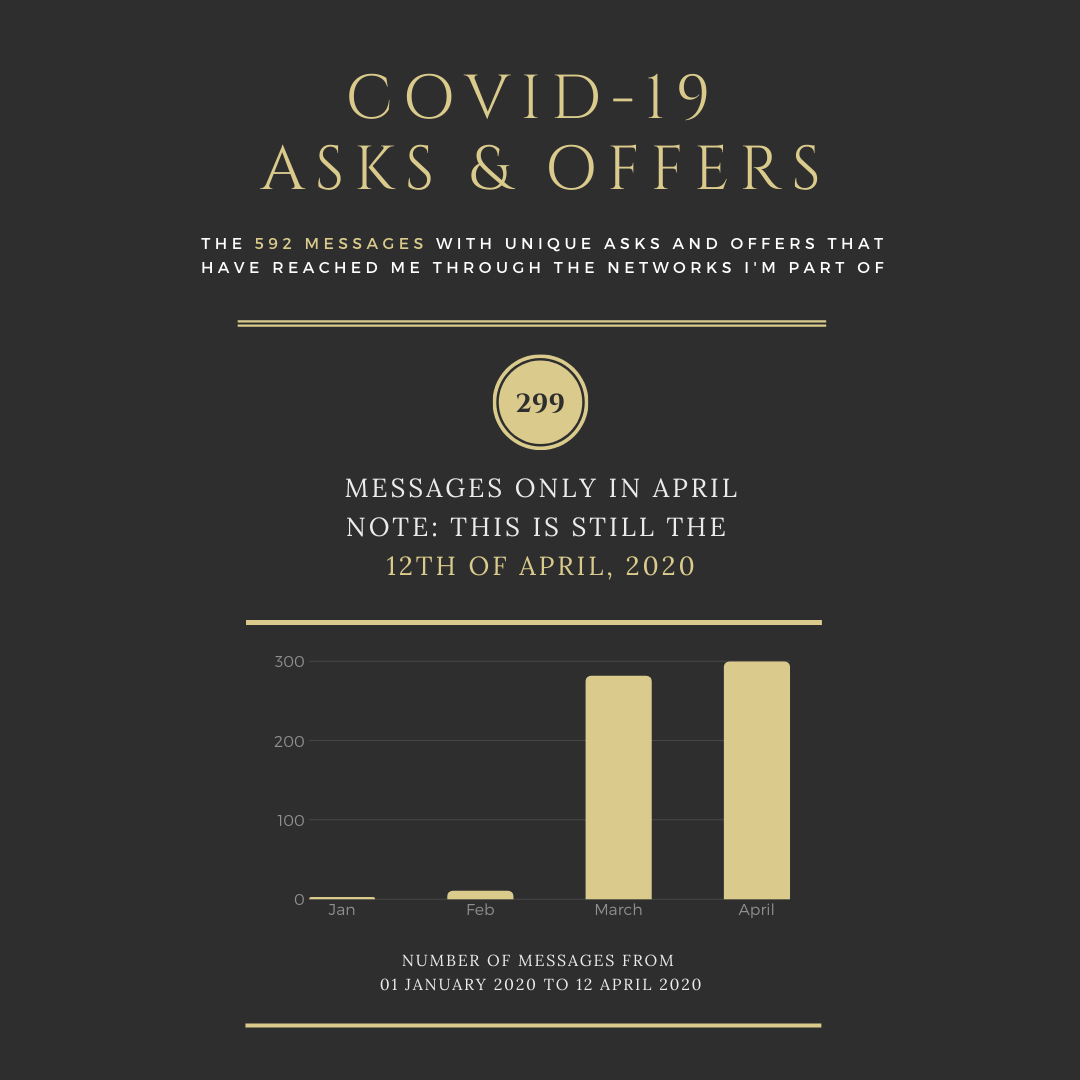

If one thing was clear from having spent some time during peak COVID infections times – back in 2020 – helping match supply and demand of essential and emergency resources (via my then side project Focus Fork) was:

How shady a business is, can often be difficult to judge.

You may wonder what I mean by shady though. Business shadiness comes in a spectrum of forms. Here I am conflating:

- Businesses that did not fulfil multi-million-dollar purchase orders after the deposit was paid (and subsequently ceased trading).

- Businesses that manufactured PPE with no modern human slavery safeguards in place.

- Businesses that followed no environment sustainability guidelines in their operations.

Finding sellers that share your values may prove hard. Seller’s “About” pages may be unhelpful. You may get on the phone with a seller’s representative and they may not be able to tell you if the company actively manages ethical and sustainability standards in their supply chain, or whether they have zero tolerance for modern slavery and human trafficking.

It suddenly makes sense why so many companies do not have alternative suppliers, much less have a supplier diversity strategy in place.

Diversifying one’s supplier base takes concerted effort.

That said, a substantial part of the average company’s environment, social, and governance footprint lies with suppliers. As a result, the procurement function is baking more and more CSR (corporate social responsibility) / ESG (Environmental, Social, and Governance) inquiries into their RFIs/RFPs, and will increasingly do so in the years ahead.

ESG sustainability is every company’s passport for the future (provided they have adequate product-market fit, but that goes without saying).

According to a recent McKinsey's study1, over 20% of large buyers already use sustainability measures as primary criteria in sourcing decisions or supplier reviews, whereas over 60% are working on their sustainability strategy for procurement.

Your investors are looking at you

Investing within an ESG framework is now the fastest growing segment of the asset management industry. That said, ESG can sadly be used as a very loosely defined term for “greenwashing”.

This means transparency is key to ensuring that insights and analytics can be interpreted appropriately. Some could argue that climate is the single greatest issue for society, and this should receive the greatest consideration when assessing a company. Others may consider diversity and inclusion or a living wage policy to be of equal importance to any net zero target. Independently, there must be transparency to mitigate market confusion and enhance understanding among market participants.

Your employees are also looking at you

Higher social capital can undoubtedly boost employee motivation and help attract talent through greater social credibility. This, however, shouldn’t surprise anyone. This is 2022 after all.

What surprises me, is to consistently see strong positive impact made by employee volunteer activities/resource groups. This means employee satisfaction is being helped by volunteer groups, employee-self-organized volunteer groups. Impressive right?

Do a quick check with internal comms/public affairs, I’m certain they are very much aware of how much more transparency – and marketing – is needed on how the company you work for tackles ESG challenges. Comms is also aware that employees have unanswered ESG related questions.

One never knows. You may soon get questions on how your company is dealing with Scope 3 emissions during your next all-hands meeting.

If you've enjoyed this ESG/CSR write up and would like to make a writer very happy today, leave a comment or come say hello on Twitter! I might come back with more notes on this soon enough.

Of course you are not a shady supplier

— Pat Eskinasy 👩🏻💻🌳 (@celue) July 23, 2022

And your prospective customers are certainly aware of your ethical credentials, right? If not, your employees certainly are. pic.twitter.com/8jkHza1tmV

Leave a Comment

Your email address will not be published. Required fields are marked *